Offshore Trusts Checklist: What to Consider Before Setting One Up

Offshore Trusts Checklist: What to Consider Before Setting One Up

Blog Article

Why You Need To Take Into Consideration an Offshore Depend On for Safeguarding Your Assets and Future Generations

If you're aiming to shield your riches and guarantee it lasts for future generations, considering an overseas depend on could be a clever step. These depends on provide distinct benefits, such as boosted possession protection and tax obligation performance, while likewise preserving your privacy. As you discover the possibility of offshore trusts, you'll uncover exactly how they can be tailored to fit your certain demands and goals. But just what makes them so appealing?

Understanding Offshore Trust Funds: What They Are and Exactly How They Work

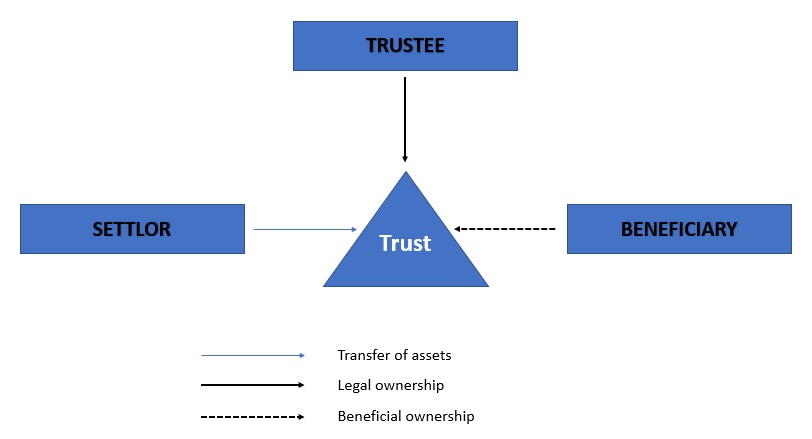

When you assume regarding safeguarding your properties, offshore trusts may come to mind as a practical alternative. An offshore depend on is a legal arrangement where you transfer your possessions to a trustee situated in an additional country.

The key parts of an overseas trust consist of the settlor (you), the trustee, and the recipients. You can personalize the count on to your needs, specifying just how and when the possessions are distributed. Because these trust funds often run under positive laws in their territories, they can give improved privacy and security for your wide range. Comprehending just how overseas trusts feature is important before you make a decision whether they're the ideal choice for your asset security technique.

Advantages of Establishing an Offshore Depend On

Why should you think about establishing an offshore trust fund? Furthermore, overseas trust funds supply adaptability relating to asset administration (Offshore Trusts).

An additional secret benefit is personal privacy. Offshore trust funds can give a greater degree of discretion, securing your economic events from public analysis. This can be vital for those wishing to maintain their riches discreet. Developing an offshore count on can promote generational wealth preservation. It allows you to set terms for just how your properties are dispersed, guaranteeing they benefit your future generations. Ultimately, an offshore trust can serve as a calculated device for protecting your monetary tradition.

Safeguarding Your Assets From Lawful Insurance Claims and Lenders

Developing an offshore trust not just provides tax obligation advantages and privacy yet likewise functions as an effective shield versus legal insurance claims and creditors. When you position your possessions in an overseas depend on, they're no much longer taken into consideration part of your individual estate, making it much harder for lenders to access them. This separation can secure your wealth from legal actions and claims arising from service disputes or individual liabilities.

With the appropriate jurisdiction, your properties can take advantage of stringent privacy regulations that discourage creditors from pursuing your wide range. In addition, lots of offshore trust funds are developed to be testing to pass through, frequently requiring court action in the trust's territory, which can function as a deterrent.

Tax Effectiveness: Decreasing Tax Obligation Liabilities With Offshore Trust Funds

Furthermore, considering that depends on are often taxed in a different way than individuals, you can benefit from reduced tax obligation prices. It's necessary, nonetheless, to structure your depend on appropriately to ensure compliance with both residential and global tax legislations. Working with a qualified tax obligation consultant can assist you navigate these intricacies.

Making Certain Personal Privacy and Privacy for Your Riches

When it concerns safeguarding your wealth, guaranteeing privacy and discretion is crucial in today's increasingly transparent economic landscape. An overseas depend on can supply a layer of safety that's difficult to attain with residential options. By placing your possessions in an overseas territory, you shield your economic details from public analysis and lower the risk of unwanted focus.

These trusts frequently include strict personal privacy regulations that protect against unapproved accessibility to your economic details. This implies you can protect your wealth while maintaining your tranquility of mind. You'll likewise limit the opportunity of lawful disagreements, as the details of your trust stay private.

Moreover, having an overseas trust fund means your properties are much less prone to personal obligation claims or unanticipated monetary crises. It's a proactive step you can require to ensure your financial tradition remains undamaged and personal for future generations. Count on in an overseas framework to safeguard your riches successfully.

Control Over Property Circulation and Management

Control over asset distribution and administration is one of the key advantages of establishing an offshore depend on. By developing this depend on, you can dictate how and when your possessions are dispersed to recipients. You're not simply turning over your wealth; you're establishing terms that mirror your vision for your heritage.

You can develop specific conditions for distributions, ensuring that beneficiaries meet certain requirements before getting their share. This control assists stop mismanagement and warranties your properties are utilized in ways you deem suitable.

Additionally, designating a trustee enables you to entrust management duties while retaining oversight. You can pick a person who straightens with your worths and recognizes your objectives, assuring your properties are taken care of sensibly.

With an offshore count on, you're not just securing your wide range however also forming the future of your recipients, offering them with the support they require while preserving your wanted level of control.

Picking the Right Jurisdiction for Your Offshore Depend On

Search for nations with strong legal structures that support depend on laws, making sure that your assets stay safe and secure from prospective future cases. Additionally, accessibility to regional banks Visit Your URL and seasoned trustees can make a big difference in managing your depend on effectively.

It's vital to evaluate the costs included also; some jurisdictions might have greater arrangement or upkeep fees. Eventually, picking the appropriate territory suggests straightening your economic objectives and family requires with the details benefits offered by that location - Offshore Trusts. Take your time to study and seek advice from experts to make the most enlightened choice

Regularly Asked Inquiries

What Are the Prices Connected With Establishing up an Offshore Trust Fund?

Establishing an overseas depend on involves different prices, consisting of legal charges, setup costs, and continuous upkeep expenditures. You'll want to allocate these factors to assure your depend on runs effectively and efficiently.

How Can I Find a Credible Offshore Depend On Supplier?

To locate a credible offshore trust provider, study online evaluations, request recommendations, and verify qualifications. Ensure they're experienced and clear regarding fees, services, and guidelines. Count on your reactions throughout the selection procedure.

Can I Manage My Offshore Trust Fund Remotely?

Yes, you can handle your overseas count on from another location. Numerous suppliers provide on-line accessibility, permitting you to keep an eye on investments, connect with trustees, and gain access to files from anywhere. Just assure you have safe web access to safeguard your information.

What Happens if I Transfer To a Various Nation?

If you move to a different nation, your overseas trust's policies could transform. You'll require to seek advice from your trustee and potentially adjust your trust's click site terms to adhere to neighborhood legislations and tax obligation ramifications.

Are Offshore Trusts Legal for People of All Nations?

Yes, overseas trust funds are legal for citizens of many nations, however guidelines vary. It's essential to research your nation's regulations and consult a lawful specialist to guarantee conformity and understand possible tax effects before continuing.

Report this page